Banking on Young People: gohenry, Current, Step, Greenlight

Banking apps for young people collectively raised over $350 million in recent months. I am looking at their strategies.

When I was very little, my grandparents gave me a birthday present - a savings account with a deposit of 1000 roubles with State Savings Bank in Soviet Kazakhstan. The deposit would be accruing an interest, but if I saved up on my allowance and contributed to the savings, I would have enough money to buy my first car at 18. Before I had time to save anything, the bank, roubles, and the country collapsed. There are stories of how people lost their lifetime of savings but it is perhaps for some future post. In any case I was taught financial planning from an early age.

A colleague told me about Australian Commonwealth Bank (Commbank as it is better known) and its Schools savings program that has been run since 1931. Bank worked with schools directly, and by the time my colleague was 25, he had a bank account for 20 years and a credit card since he was 18.

Teaching early financial prudence is important and junior banking is nothing new. In the UK and US the industry is just hotting up.

Recent funding frenzy

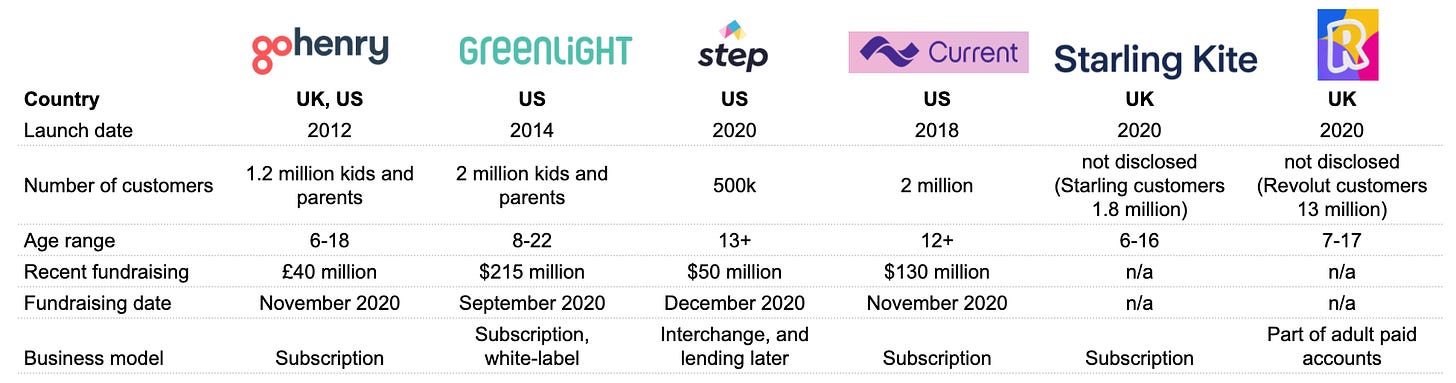

Financial apps for children, teens and young adults is a hot business right now. Away from the limelight, a crop of junior banking apps raised some substantial funds. Just in the last few months, gohenry, a UK pioneer that has expanded to the US raised its first venture round of £40 million. In the US, Greenlight reached a unicorn status having raised $215 million. Just this month, hot off the press startups Current and Step raised $130 million and $50 million respectively.

On top of dedicated children and teen apps established digital wallets and banks like Revolut, Starling and Venmo are making inroads into junior banking. Young people’s banking is a less crowded space, but that might be changing very soon. It’s great for everyone involved, because I think the biggest challenge these apps face is weak market awareness, and their biggest competitor is cash.

There is a big market, by one account there are 12 million children in the UK aged between 5-19, and more than 70 million under-18 in the US. Most of them are still using cash, but transition to digital accelerated by covid will push children and parents to apps. One of the reason startups raised so much recently is that they demonstrated incredible growth during covid.

The market is underserved, but opportunities for monetisation are limited.

Business of junior banking

Most of the apps are designed to teach kids money, so there are things like spending blocks, and daily allowances that can’t be exceeded. For example, gohenry’s spending limit stands at 10 transactions per day or £45 per transaction. Greenlight sets the monthly spending limit at $5k. As a result, the opportunities to earn transaction fees are small.

On top of that, these apps don’t and can’t offer any lending, and savings made by children are most likely very small. Other fees that include cards personalisation, ATM withdrawals and top-ups are designed to recover costs, rather than generate recurring streams of revenue.

As such, the only viable consumer revenue stream is subscriptions. Then by extension, junior banking is a scale business. And the best place for scale business is to be close to the source of scale - adult banking.

User economics primer

Companies House is a gift that keeps on giving. I retrieved gohenry’s 2019 annual report which allowed for the sneak peek into its financials and user economics. I believe that it is broadly representative of the industry (US market has higher transaction fees).

Last year, gohenry had just a touch less than 1 million customers of which slightly more than half were children whose accounts are priced. Despite having 5% of the market share in the UK, the revenue last year was £13 million, up from £8 million a year earlier (Revolut made ~£160 million, TransferWise - £300 million).

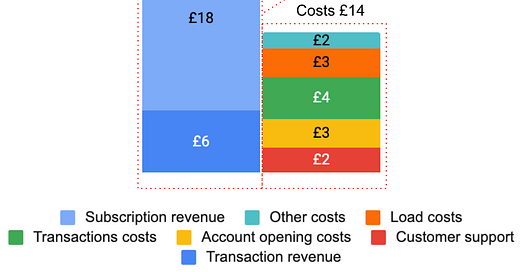

Using children account numbers, the annual revenue per child came at £24, of which £18 is from subscriptions. The maximum subscription revenue is £36 per year, so at £18, gohenry converts 50% of its customers into paying subscribers.

There is no breakdown of revenue, but I extrapolated transaction revenue from transaction costs, which came to £6 per child per year. Children just don’t spend a lot. gohenry announced that customers spent £100 million last year, which translates on average to £140 per child per year.

Subscription allows for a healthy gross profit margin of 40%, but add to that customer acquisition costs, and depending on the growth plan, it is hard to see profitability in sight. gohenry in fact announced that they are profitable, but with £40 million funding they will be spending a lot on marketing.

For a subscription based business, one of the key measures is a ratio of lifetime value to customer acquisition costs. Industry benchmark of LTV:CAC is 3:1. Last year on average, gohenry spent £20 per new child account. Assuming an average tenure of 6 years, and gross profit per customer of £10, LTV to CAC for gohenry equals 3:1.

The are few ways to secure a good LTV:CAC

as monetisation is limited to subscriptions, LTV is driven by tenure - companies need to make sure that customers stay on longer, by for example having an adult banking product

CAC could be decreased from virality and referrals, or through finding another distribution channel, i.e. converting to B2B

It is in fact what these companies are doing, bar one which I believe will change its business model.

Strategies

Despite similarities in the stated goals, features, and pricing these apps are approaching growth very differently. There are several noticeable paths:

Building junior banking within adult banking product (Starling, Revolut, Venmo)

Starting with a junior banking, but growing up with customers (Step, Current)

Stand-alone junior apps (gohenry, Osper, Greenlight)

1. Building junior banking within adult banking product

Family banking is a feature that can have a strong customer retention pull. With most neo-banks offering joint accounts for partners, friends and family, addition of a junior account is expected. These banks see junior offering primarily as an enrichment of adult banking experience, rather than a new category. For example, Revolut Junior is only available to existing premium subscriptions customers.

The marketing message is also directed to parents, i.e. main account holders:

Revolut: Designed for kids, controlled by you

Starling: Help kids manage their pocket money and turn their spending into skills.

Building a junior extension is also a relatively low investment, as most of the features just transitioned from the main app.

Details of the take-up are yet to be disclosed, but demand has been very strong according to Starling.

As a side benefit, when children grow up, they could graduate to main account customers. By running a thin margin business on kids (or even a cost center), neo-banks would have acquired loyal customers when they are still young. However, I don’t think that it is the main driver for neo-banks today. Theie priority is to monetise adult accounts and so adding a junior feature is viewed as a driver for adult engagement.

2. Starting with a junior banking, but growing up with customers

Step and Current, are offering independent teen banking experience. But unlike other apps that have upper age restrictions, these products plan to grow up with their customers. Targeted at older children and teenagers these companies advertise directly to them, rather than to parents, using influencer power (e.g. TikTok star Charli D'Amelio endorses Step), viral campaigns and giveaways.

They want to be primarily cool, as that’s what matters to teenagers. As such, their growth could be viral, and importantly cheap. Step has half a million customers having launched in October. Current has grown to two million customers in less than two years.

When it comes to monetisation, Current uses subscriptions as well. But having started as a teen banking app two years ago, Current now has a broader appeal with checking accounts, salary advances, free overdrafts, points, etc. Teen banking is still one of its pillars, but it is already building up features that would appeal to teens when they grow up.

Step, in contrast to other apps, positions itself as a no fees account. Monetisation will come from interchange today, and from lending later, as the founder said:

“As teens grow up we want to grow with them,” MacDonald said. “We will start offering products when they go to college, for example lending money to get books or computers.”

This is bold and comes with a long payback period, but it plays to the implied priority: customer growth and brand affinity. Monetisation can come later.

Stripe led Series A and participated in the recent round too, its head of M&A is on the board of Step. Both companies partner with Evolve bank. I can see a bigger play for Step in Stripe’s ecosystem of being a platform of platforms. With Stripe going into banking-as-a-service and lending, in the future why not move into extending teen banking? Stripe could, for example, offer Step to young and teenage entrepreneurs who start their companies on Stripe Atlas.

With that broad goal in mind, subscription fees could block wide adoption, where a distribution channel will add a massive scale. This product with Stripe’s platform could support teenagers with economic participation, and by extension, grow the GDP of the internet.

3. Stand-alone junior apps

Greenlight in the US and gohenry in the UK are both pioneers in child banking. Launched in 2014 and 2012 respectively, they cover younger age children from 6 or 8 years old.

gohenry grew to 1.2 million customers and has 5% market share in the UK. Unusually gohenry bootstrapped to profitably which they reached in March. The company was financed by friends, family and public crowdfunding before raising its first venture round last month.

Greenlight has 2 million customers and is valued at $1.2 billion. It has raised a massive round of $215 million in Series C in September on the back of covid related growth. It is now working on launching investment products and app redesign.

Unique children features including spend limits, payment for chores, saving up for big purchases have been invented by these companies, and now are adopted by all other apps. Both companies position as financial education providers dedicated to teaching kids financial literacy, importance of chores, delayed gratification:

gohenry: gohenry, a global leader in building healthy financial habits for kids

Greenlight: “We want children to start to manage their own money and learn to make decisions. When it is their money, they are more thoughtful about their purchases.”

As an extension, both of these companies focus just on kids, and don’t have adult banking companion offers. The limitation of such a business model is customer churn. Unlike adult banking with low churn and high retention (only 1-2% of customers in the UK switch their accounts annually), junior banking customers tend to grow up. So the churn in junior banking is by age cohorts, rather than in single percentage points.

gohenry, the oldest of the pack having launched eight years ago would probably have the best historical data on churn. Having an age range of 6-18, the average lifetime of an active customer is probably less than 10 years. In fact, by the time children reach teenage years, they might switch to the cool brands a la Step and Current. So the effective lifetime will probably get lower, at 5-7 years.

Recent funding of £40 million will be dedicated to grow the US business. In the annual report, on average gohenry spent £20 per new user last year. Assuming that gohenry spends £20 million at the same cost of acquisition, they will add 1 million customers. With limited monetisation, it is not exactly the scale that would pay out on £40 million investments.

Greenlight might have found a way. Recently they scored a partnership with JP Morgan Chase to white-label its platform for the launch of junior account Chase First Banking. JP Morgan Chase has 30 million active customers vs two million of Greenlight, so the scale factor is unmatched.

JP Morgan and Wells Fargo have invested in Greenlight. Both of these banks practically cover the retail banking space in the US, and having a JP Morgan as a partner to reach that scale is a great exit. I don’t know the structure of partnership fees, but whatever it is, the revenue upside should not be underestimated.

Citi Ventures (arm of Citi Bank) participated in the gohenry round as well, and so perhaps gohenry will be rolling out Citi’s child banking offer too.

Conclusion

I like the idea that children as young as six can start learning about finances. I also like that new and innovative companies can lead the way for how we talk about money and do our finances. Financial literacy starts from the early ages.

But these companies need to have a plan in place, because children tend to grow up fast. Most of the companies in this profile seem to have figured it out, be it graduating children into adult customers (Revolut, Starling, Current) or relying onto B2B channels (Greenlight and Step).

There is a massive respect for what gohenry has achieved. From lead investor Chris Sugden of Edison Partners:

“gohenry is catering to millions of parents who are looking to raise smart, financially literate children but are currently underserved by existing solutions. We’re thrilled to partner with Alex and the gohenry management team on this next milestone in their growth journey and look forward to realising their ambitions to improve the financial fitness of kids across the globe.”

But it doesn’t have a defined future plan yet, aside from growing in the US. As it stands now, it could continue being a great child account, as the market is large and underserved. But the competition from neo-banks and teen products will increasingly squeeze its potential.

The path forward may be the one pursued by Greenlight. Citi bank, an investor in gohenry, already operates a program called Kindergarten to College, a platform managing San Francisco child savings accounts designed to help public school kids save up for college. There might be a natural synergy with gohenry.