Kaspi.kz - What’s Next for the Most Important Company in Kazakhstan

A profile on Kaspi.kz - a bank turned technology company that IPO’d in London last month raising over $1 billion and becoming the largest listing out of Central Asia

Kaspi.kz is an incredible success story and I was really excited to finally deep dive into it. I was not living in Kazakhstan when Kaspi took the country by storm, but on my visits and from tales from f&f I got to see how Kaspi is different. Relentless focus on customer service propelled it as the most trusted brand (for example you could self-print a new card in kiosks and withdraw cash at their ATMs without card, among many other things). But its ultimate competition is itself - could Kaspi challenge its own approach to how successfully it can grow beyond and outside of Kazakhstan?

In this post:

How it Started

Payments: The Life Blood

Marketplace: Amazon of Kazakhstan

Fintech: The Crown Jewel

What’s Next for Kaspi

Kaspi IPO’d in London last month at $6.5bn implied market capitalisation, and as of writing it has risen to over $8bn. It was the 2nd largest listing in London this year and the largest IPO out of Kazakhstan (2nd largest by proceeds behind oil giant KMG EP).

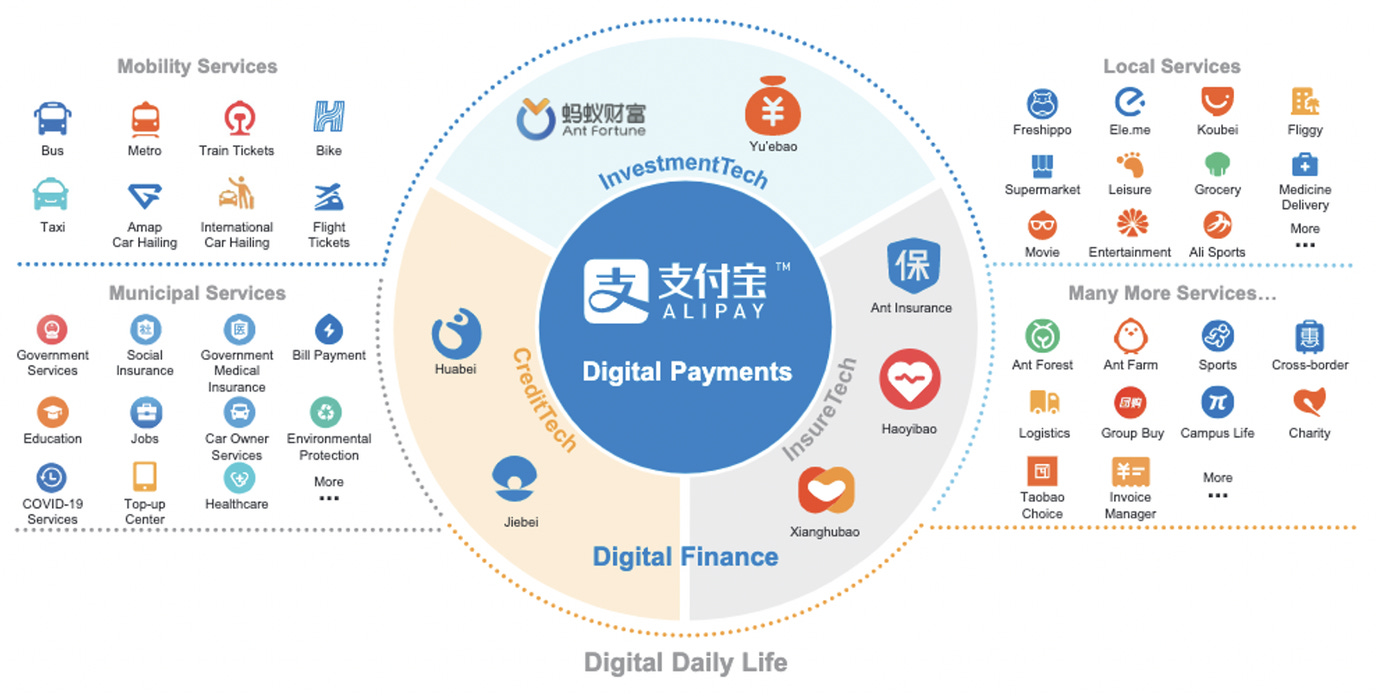

Kaspi is a technology company wrapped around a bank, or a bank turned tech behind Super App. It models itself after other super apps like WeChat, Ant/AliPay, Gojek.

Gojek’s definition of a Super App (more great analysis on Super Apps is here)

A Super App is many apps within an umbrella app. It’s an Operating System that unbundles the tyranny of apps. It’s a portal to the internet for a mobile-first generation

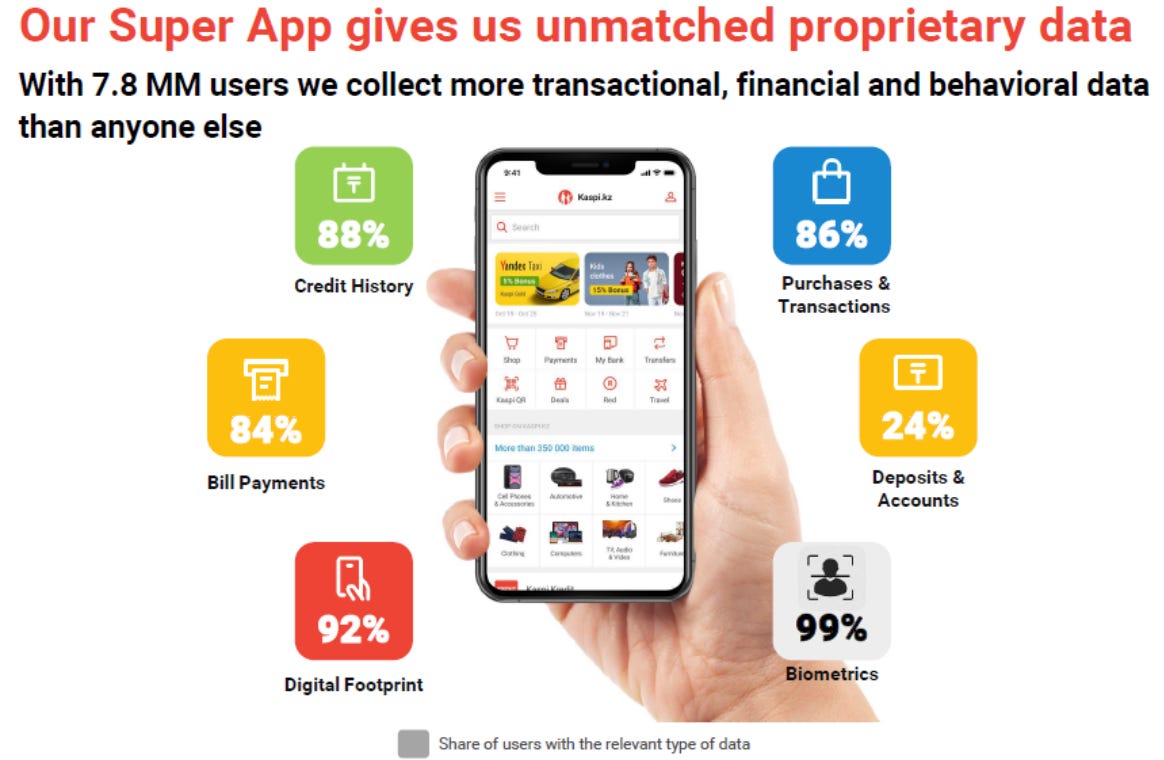

Kaspi’s Super App platform has three key sub-apps or segments: payments, marketplace (e-commerce) and lending (which they call fintech). Today, however, Kaspi is overwhelmingly a bank as 80% of its revenues and 70% of its profits are from lending to customers. It originates 100% of loans from its own balance sheet (vs 2% for Ant/Alipay).

An example of rapid and successful disruption, by all meaningful metrics, Kaspi is a huge success - it has 8 million monthly active users in the country with just 18.6 million people. Last year it made $1.4 billion of revenues and $500 million of net profits at an incredible 40% profit margin. It upended card acquiring networks such as Visa and MasterCard, now accounting for 66% of all payment volumes in the whole country. Its marketplace platform is the largest e-commerce channel in the country, and a single “Black Friday” day accounts for 4% of all annual e-commerce sales in the whole country. It is an incredible company that executed extremely well across all segments.

Kaspi proved that there is tremendous value in a small and disperse market as Kazakhstan - often a limitation to investors. In fact, Kaspi’s annual revenue per user in 2019 was above $220 - which is higher than that of Google and Facebook.

But I am curious what lies ahead and outside of saturated Kazakhstan, so in this profile I am digging on what Kaspi should do next. But first...

Past: How it started

The most incredible part of the story is that Kaspi started back in the 1990s riding the wave of corporate financialization of post Soviet Kazakhstan. It was a small corporate and SME lender when in 2007 Baring Vostok, a private equity fund operated out of Russia, acquired a substantial stake. Firm’s partner Mr Mikheil Lomtadze was installed as bank’s CEO, and years later became a major shareholder with Baring Vostok and Mr Kim, Kazakhstan’s influential businessman.

Mr Lomtadze had a long term and singular vision of Kaspi, but the modern day disruption story didn't start until 2017 when the mobile app was launched. Mr Lomtadze decided to rebrand a retail bank into a fledgling technology company behind a Super App. One reason - valuations of tech companies can command much higher multiples and Kaspi’s market capitalisation is evidence that the plan worked.

It was a blockbuster product launch. Today more than 90% of all customer’s interactions with Kaspi are in the app despite a vast branch network (1000+ branches).

Kazakhstan’s market proved to be fertile for a Super App for a few reasons:

Mobile first generation was especially perceptive to app-native environment

Network effects generated off peer-to-peer payments functionality which de-facto replaced cash transactions. Today almost any type of cash transaction between individuals could be facilitated by Kaspi’s app (paying for a taxi ride, for takeaway, splitting the bills)

Relatively nascent home grown internet infrastructure - for example absence of Amazon type marketplace created a niche for Kaspi to step in to consolidate merchants. Kaspi’s online e-commerce channel is the single biggest channel in the country

Poor existing banking infrastructure and low levels of trust (bankruptcies, takeovers and fraud reduced people’s trust in banks)

Despite the core of the app being built for Payments and Marketplace, the biggest revenue push has been historically from lending.

Close to 80% of revenue is from lending and average revenue per user that Kaspi gets from lending is 6x-8x higher than from Payments and 10x higher than from marketplace.

Payments: The Life Blood

Investing heavily in Kaspi-native payments was a killer move to build the strongest competitive advantage: customer network effects and access to wallet. These developments included P2P payments, QR code enabled payments with merchants, etc. The internal closed loop payment system maintained by Kaspi is now so dominant in Kazakhstan, it accounts for 66% of all payment transactions.

The most impressive stat is the speed at which it was achieved - just over a year earlier that share was 2%. It is a testament to Kaspi’s product development and shipping abilities, but a lesson for giants Visa and MasterCard on how their business model can be disrupted.

Payments as a segment is well penetrated - more than 85%-90% of MAU use payment products. It is also the driving force behind a sustained customer growth. Network effects achieved via free payments allowed Kaspi to basically gobble up market share for free and construct the biggest competitive moat. Sales and marketing costs are just 5% of revenue.

However, in order to achieve that Kaspi had to forego interchange revenue that it would have earned via Visa/MasterCard, effectively replacing it with free in-Kaspi transactions. Share of revenue generating transaction volume dropped from 92% to 29% in just three years. In essence, forgone transaction interchange revenue which is very considerable (the biggest revenue for Monzo, Revolut, etc.) is the cost of acquiring customers.

Management’s trade off of portion of the revenue for customer acquisition has paid off. Kaspi’s penetration into Kazakhstan’s adult population is astonishing 60%. Investing in payments allowed Kaspi to achieve a scale to stake out Amazon of Kazakhstan.

Marketplace: Amazon of Kazakhstan and more

Kaspi was lucky in its timing, there haven't been big E-commerce consolidators in the country and generally online retail was very nascent.

Started in 2014, it is now the largest online commerce destination in the country. Not only Kaspi onboarded merchants on the platform, expanding categories from electronics to clothing, accessories etc. It is providing fulfilment, financing, higher sales conversion, customer acquisition and retention. It went deeply into merchants' networks providing each with QR code readers and POS terminals only to be able to maintain the closed loop ecosystem.

Kaspi facilitates online and offline purchases via bonuses, points and other perks thus significantly increasing purchase conversion for merchants.

Merchants are vying and in some instances ready to provide bigger commissions just to get on a platform. But crucially it is the main channel in loan origination (Buy Now Pay Later products) which is the highest revenue and profit driver.

Fintech: The Crown Jewel

With yields of 30% from originating several billion dollars every year (COVID has slowed-down that down, although there are signs of recovery) makes up a very hefty revenue proportion - in 2019 full year fintech brought in $1 billion in revenues within $1.3 billion of total.

Both payments and marketplace segments are utilised to drive lending. But growing lending is not the end in and of itself. Yields of 30%+ are not unheard of and even in the UK overdraft and credit card products in many cases could charge more. Given loans originate in Tenge which is under inflationary pressure, real yields are significantly less. However, pricing loans for risk is much harder. Here is where data science comes in - Kaspi’s proprietary credit scoring system.

The results speak for themselves. On the book of $3.3 billion, only 5% of loans are gone bad (so called “stage 3” in IFRS terminology). This ratio for Halyk Bank, the biggest bank in the country was 16%. A great outcome allows Kaspi to grow lending safely and extremely profitably.

What’s next?

The biggest question is can Kaspi scale and grow outside of its Kazakhstan success story. It ecosystem or operating system was key in delivering the success, but it is also a limitation to scale:

Kaspi’s growth strategy is around acquiring or developing in-house almost all products it offers on the platform. With the exception of partnerships with government agencies on tax and traffic fine collections, Kaspi owns supply end-to-end. This approach is hard to scale when expanding abroad, as it will be faced with high costs, integration challenges and protectionist/regulatory pressure

Creating customer value in-house is inherently slower, than partnering with providers. By extension it means that customer acquisition will be slow, as there won’t be enough supply to entice growth

Lending as a core revenue driver is hard to scale from the balance sheet. Currently Kaspi loans out 80% of its deposits and so growing lending beyond that in other markets would require a lot more funding. Originating loans and outsourcing underwriting is faster to scale and doesn’t require huge initial investments

So, what should it do?

In the internet economy companies that sustain superior user experience will always have an advantage over competition. Kaspi’s focus on customer satisfaction to the exclusion of almost anything else, is the right long term game. This has earned them a lot of loyal and profitable consumers.

However, Kaspi can capture more value outside of its current ecosystem, if it opens its platform up to other suppliers, effectively becoming an aggregator. Kaspi already has two out of three key characteristics as defined by Ben Thompson, author of the Aggregation Theory:

✅ Direct relationships with users: Kaspi has direct relationships with users and with their wallets. It can effectively control supply of products and services (which is abundant in theory) to users (who are scarce). Users will always have a primary relationship with Kaspi.

✅ No marginal costs of serving new customers: Kaspi has near-zero marginal cost of serving additional customers. Typically for other businesses these would include cost of goods sold (none for Kaspi as it provides digital goods and services), transportation costs (none for payments or lending), and transaction costs (eliminated via building Kaspi Pay infrastructure). So any new customer on Kaspi’s platform is not generating additional marginal cost. This allows Kaspi to grow its user base effectively which is the biggest competitive advantage.

❌ Commoditization of suppliers on the platform: Kaspi develops all of the supply in-house. But it is slow and costly. Once aggregators have a considerable and direct user base, suppliers will start coming onto the platform and often on aggregator’s terms, effectively becoming a commodity to serve more customers. This will then lead to even more customers and even more suppliers, further reducing customer acquisition costs.

Here is an example of WeChat’s Mini Programs - third party applications allowed to integrate and build on the platform.

And third party apps that currently are on WeChat.

In the case of Ant/Alipay - they only underwrite 2% of their loans, outsourcing the rest to other banks and taking a commission instead (although that will change with new Chinese regulation that stipulates 30% of loans should be from the balance sheet).

Notice the remarkable similarity between visuals with Kaspi’s Super App, but still, the contrast of how much Kaspi’s app is missing in terms of service is quite stark.

As Kaspi models itself after the Super Apps it needs to look closer where they capture the value.

Becoming an aggregator makes sense for a number of reasons (one of them is that all FAANG companies are aggregators):

Outsourcing expertise: Kaspi’s strategy to date was focused on owning all of the supply. Even where Kaspi doesn't have the expertise - like travel booking or utilities billing - it chooses to acquire these companies. But it will be increasingly difficult and limiting in scope.

Virtuous cycle between users and suppliers: Kaspi cares about customer experience - more suppliers and programs would enhance that for customers. This in turn would bring in more suppliers at Kaspi’s terms. Which then in turn attracts more customers.

Reduced costs: Becoming an aggregator reduces costs further, particularly those related to customer acquisition. For example, Kaspi has near zero marginal costs of serving users - i.e. it doesn’t cost extra to produce a service or to deliver it (except Marketplace transportation). But the key is customer acquisition which it will need to pay its way through when expanding abroad. Creating customer value in-house as it currently does, will eventually limit the growth outside of the initial product-market fit.

Without going into a lot of esoteric partnership, some obvious financial services on Kaspi’s platform could include:

Savings and investments (particularly popular stock trading)

Remittances and international transfers

Insurance

Lending for other needs like cars, and mortgages

Crypto exchanges

I think one of the Kaspi’s most valuable asset is its long-term and committed leadership. Management team that Mr Lomtadze brought with him 14 years ago is all still there. He has a singular vision and commitment to that vision, but importantly he is not chasing fast outcomes and makes some ruthless trade-offs.

Throughout its development Kaspi made critical laser focused decisions that could only have been fruitful in long term - I already touched on foregone interchange revenue. Other examples included re-shifting to retail segment and closing down corporate business, closing down bad faring credit cards, etc.

If Mr Lomtadze keeps thinking long-term, I don’t doubt Kaspi will become a global story. To end with a quote from another long term thinker Jeff Bezos:

If we think long term we can accomplish things that we wouldn’t otherwise accomplish. Time horizons matter. They matter a lot.

Disclaimer: I don’t own shares in Kaspi, and this is not an investment advice

Kaspi financial data is from its IPO prospectus

Insightful and simple read, Aika, well done! Just subscribed to your blog

Very nice