Fintech in LatAm: Banking the Unbanked

Nubank, Ualá and others building a path to LatAm customers

Hello and thank you for reading! I haven’t been writing since I joined Wise (I am having a lot of fun and will probably share more in some of my future posts). I am really pumped to share this piece that has been brewing in my mind for far too long - its about LatAm, fintech, and the long term impact.

When you ask a question of what comes first - innovation or growth, the answer is obvious in abstraction. Growth without innovation is impossible. Case in point - our economic output hasn’t grown much for 2 millennia until the start of the Industrial Revolution in England in mid-1800.

Innovation sets the flywheel - more people have more money that they can spend on more stuff, which results in even more people having even more money. With economic growth people’s demands become more sophisticated, and that is a base on which new innovations and new ventures are built. A lot of tech innovation wouldn’t have been possible without a level of affluence that became attainable in developed markets only relatively recently.

This concerns a lot of fintech innovation. In the US and Europe the early wave of fintechs like Paypal, Stripe, and Square have probably created more economic output by levelling the access, which allowed the likes of Chime, Robinhood and Klarna to scale (indirectly, by grooming customers). Similarly, Nubank has probably had a larger impact on economic opportunity in Brazil than Revolut did in the UK. If Nubank introduced 20 million people to a banking system, that will have a big multiplier effect on Brazil’s economy - these people can start saving, borrowing, shopping online, and scaling their businesses. Revolut, on the other hand, has changed the way we bank but its customers were already pretty well served by incumbents. That’s why it is so exciting to look at fintech growth in developing markets - Africa, APAC, LatAm where fintech innovation directly leads to better economic outcomes. Everett Randle did a far better job explaining impact of fintech in developing markets when he wrote about Wave, a fintech from Africa that raised $200M:

$200M is going toward building financial infrastructure that could one day improve the lives of 1 billion+ Africans

Latin America opportunity

Latin America is a huge market - 650 million people with a median age of 31, with GDP per capita reaching $15k, on par with China and ahead of India at $5k. For a number of different reasons LatAm startup ecosystem lagged behind other developing markets, but make no mistake, this giant is waking up. Almost a week doesn’t go by without new funding announcements. From TechCrunch:

Latin America is on pace for all-time records in venture capital dollars raised and venture capital rounds in 2021. According to CB Insights data, startups in the region have already raised $9.3 billion in 2021’s first six months from 414 deals. The same data set indicates that in all of 2020, startups in the region raised $5.3 billion across 526 deals.

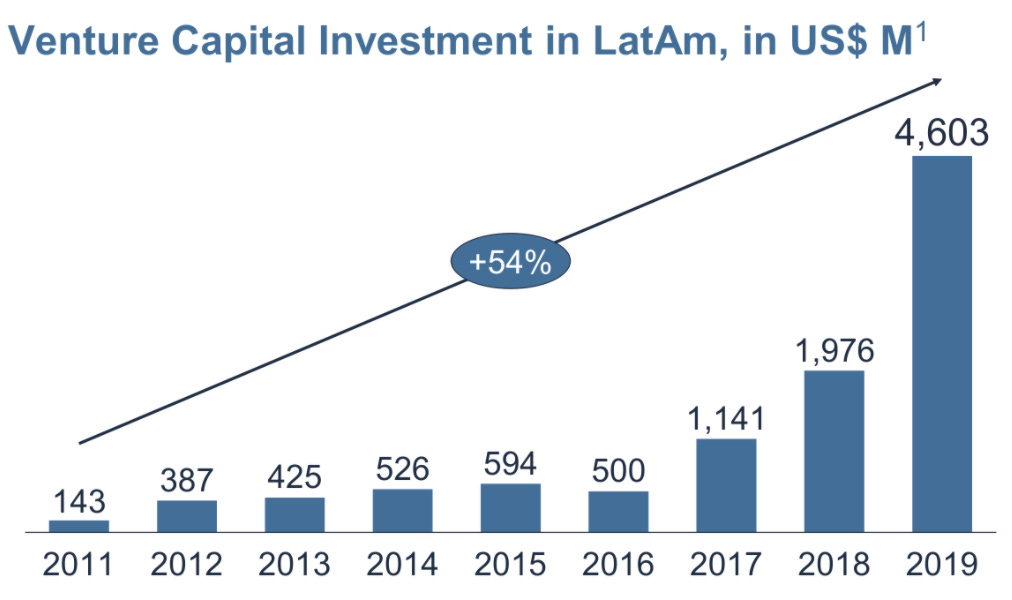

You can imagine extending this chart with 2020 being a $5.3 billion, and 2021 first six months of over $9 billion. Mind blowing!

What makes this place so exciting? Demographics and market dislocations:

Demographics: huge market, young and growing population, little language barriers inside the region

Market dislocations: growing GDP per capita and growing middle class, one of the highest levels of smartphone penetration, and at the same time, highest levels of ‘un-banked’ population. In Brazil - the most developed country in the region, it stands at 40%, in Mexico - it is 70%. In China this number is no more than 10%.

There is a giant opportunity to enable over 400 million people to save, spend, and get access to a growing share of the online economy - just imagine how hard or expensive it is for people to get a Netflix account, Uber ride, or Amazon delivery if they don’t have a card or digital wallet. But they all have smartphones. David Velez, the founder and CEO of Nubank says in his recent podcast interview:

Some of the biggest opportunities are in these markets that have a significant failure and where technology adoption suddenly creates an opportunity to beat the incumbents. A lot of investors go very deep and are able to understand with a lot of clarity, why these market dislocations, this market failure, and then understand how the company is able to find that unique angle into filling that market dislocation.

Successful fintech companies are benefitting from finding and leveraging these dislocations. The sure sign here is how fast they grow. Nubank has grown to 40 million customers in less than eight years - it is the largest neobank in terms of customer numbers, and for sure one of the largest banks full stop. Ualá recently made waves with fundraising led by Tencent and Softbank at $2.5 billion valuation, building an ecosystem out of Argentina, having acquired over 3 million customers in three years, and is onboarding 1% of the country every quarter. There are smaller faster growing neobanks such as Neon, albo, Klar, Stori that are fundraising from Silicon Valley’s top VCs. At the same time Mercado Libre, Rappi, and OXXO, super fast growing businesses themselves, are diving into solving fintech. All of these companies are serving ‘underserved’, disrupting incumbents and providing access to digital financial economy. I want to dive in into some of them.

Nubank - the naked bank

Nubank is one of the more familiar stories of LatAm. There is a lot of great writing about the company - for example by TechCrunch and by The Generalist. David Velez has been on a couple of great podcasts too (here and here), shining the light on origins and thinking. Nubank is 100% going to be a multi-hundred billion company. Why is that? Two obvious answers: strategy and execution. A common thread of successful founders that I am seeing again and again is thinking in long-term, multi-decade time horizons - that is a significant advantage against others who optimise for short term impact. Nubank and David think long term, but complement that with smart tactical choices.

Strategy

From the outset David Velez knew what he wanted to build, and he gathered an experienced team around. A Colombian native, after his Stanford MBA he was sent to Sao Paulo to scout LatAm opportunities for Sequoia. In 2011 there were none (unlike today), but having studied financial industry in Brazil (perhaps the most profitable in the world based on net interest margins) he set out to pursue his life-long dream - start a company. Sequoia seeded Nubank in 2013. David and his team were disrupting a formidable structure - top-5 incumbent banks had a 90% market share (practically a banking cartel), were among the largest companies in Brazil, and had regulators on their side. David says:

We have spent months hearing from everybody that it was completely impossible and almost ridiculous, what we were trying to do. I heard so many times, "You are not even Brazilian. You have no idea what you're talking about. It's impossible to go against these guys. You don't know these local." We were hearing the no and the skepticism so often from so many different people, that there was a huge sense of urgency to prove everybody wrong.

That positive energy was channeled into a big vision - Nubank was going to be a fully digital, free, friendly and accessible bank with customer needs as the highest priority. That was unheard of in Brazil, and also really not very common even in the US or Europe at that time. What was needed is a set of strategic choices that would align the company on long term success, and tactical decisions around how the long-term success is going to be achieved.

Examples of long-term thinking:

Being compliant with regulation - there is a level of arrogance in fintech founders that are disrupting the incumbents from the first principles. But regulators can make fintech company’s life very very hard. So it is very smart that Nubank chose to be friendly to them - if you want to stick around for decades, and regulators are going to be there for even longer, it is wise to not pick fights with them.

Building the foundations in house - deliberately going slow on features by building foundations of the business (payment systems, ledgers, integrations, etc - but also back in 2013 there were none of current rich BaaS offerings). This puts pressure on the shipping speed, but once foundations are built, it is very easy to scale - Nubank added 30 million customers in the last two years.

Customer obsession - but that’s not contentious at all, that’s how fintech wins.

To make the main product fee-free and sustainable it needed two basic variables - low costs and monetisation strategy. Examples of tactical choices included:

Start with credit cards - starting with credit cards was a necessity - Nubank didn’t have a banking license, but that might have been a choice. Nubank started monetising customers from the outset. Credit models were stress-tested since the start by Brazil’s numerous economic downturns and recessions. Importantly David speaks how they needed to remove monetisation uncertainty in order to attract capital - they needed a lot of money, but very few were investing in LatAm. Delaying sustainability was not a luxury they had. To that extent, the product list that Nubank built is all about unit economics and growing customer lifetime value.

Lean cost structure - no branches and being digital today means Nubank has 4k people working vs 100k people working in top-5 banks in Brazil. In addition, Nubank doesn’t have customer acquisition costs. Making the main product fee-free and accessible meant that people just told their friends and family about it. David says that 90% of customers are referred.

Nubank is not reinventing a business model, but it stayed true to its mission. Consequently adding more products such as full current account, asset management, insurance, consumer lending, the company was able to unlock more customer segments.

With a rich product stack, growing acquisition engine, expansion to Mexico and Colombia, Nubank’s enormous potential attracted Warren Buffet, a notable investor in financial institutions. There are now talks of a new funding round that would value the company at $50 billion, before it plans to IPO early next year.

Execution

With 40 million customers, Nubank is the largest neobank in the world, but it is also one of the largest banks in Brazil. Its customer base and valuation is comparable to the top-5 in Brazil, but the variance in scale efficiency is a textbook disruption. Nubank has less than 4000 employees, compared to 96,000 of Itau and 100,000 of Bradesco. Nubank’s 1 employee effectively serves 10k customers, compared to an average of 700 customers for Top-5.

Digging deeper into Nubank’s financials shows that the company can execute. In 2020 it made roughly $900 million in revenues, but the structure was surprisingly diversified. As Covid pandemic raged on, Nubank managed to realign itself to less risky sources of revenue, growing commissions and fees, while lending was restricted. Non-interest income grew from 40% to 60% of total revenues within two years - I suspect as Covid outlook becomes less volatile, credit has picked up this year.

Similar to US neobanks in LatAm interchange is high, reaching up to 6%. Other fees that grew during that time are from mobile top-ups and cash withdrawals. New additions such as insurance and asset management would contribute to non-interest income considerably as these would also be products used by more affluent customers who would bring more spending with them.

In terms of asset allocation - out of roughly $6 billion in deposits as of Dec-20 Nubank was lending only about a half, mostly as part of credit cards. This is conservative, and likely in response to Covid. Its portfolio health is actually quite good for a developing market - only about 7% of credit card portfolio was provisioned, for personal loans that number stood at 13%, down from 19% in June-20.

Overall in 2020 Nubank made roughly $375 million in gross profit on a revenue of almost $900 million, but is yet to reach profitability - it had a $42 million pre-tax loss. However, that’s just a matter of time - just two years ago Nubank had 10 million customers, so the 30 million customers it acquired will ramp up to get Nubank into black.

But what’s next? In Brazil they have solidified their position, eating the turf of the top-5 by going up in the product stack with insurance, asset management, potentially more with consumer lending and mortgages. I don’t think Nubank will be pursuing a super app strategy in Brazil - they always wanted to be a better bank, and there is still more to do. Nubank is now expanding to Mexico and Colombia, where market opportunity is even bigger - more unbanked people, less competition.

Nubank’s strategy and execution have been top notch so far, but Mexico is shaping up to be a tough battleground for fintechs and their varying business models. One of them is a fascinating young company called Ualá from Argentina.

Ualá - enabler of digital economy

Ualá was founded in 2017 in Argentina by Pierpaolo Barbieri, recently valued at $2.5 billion following a Tencent and Softbank led Series C fundraise of $350 million.

Founders of successful companies are all very impressive, but I have to admit, Pierpaolo is striking in his achievement, and the span of his interests. Just look at his bio on a Greenmantle website, a political consultancy headed by Niall Ferguson, where Pierpaolo is an executive director:

Pierpaolo holds an AB magna cum laude from Harvard University and an MPhil from Cambridge. He is currently senior associate at the Applied History Project at the Harvard Kennedy School and was Lt. Charles Henry Fiske III Scholar at Trinity College, Cambridge. He is also the founder of Ualá, a financial inclusion project in Argentina. His first book, Hitler's Shadow Empire: The Nazis and the Spanish Civil War has been published in the U.S., UK, Italy, Spain, Argentina and China. He is fluent in Italian, Spanish and French.

He is only in his early 30s. So why did a political and economic historian, scholar and author of the book, founded Ualá, a digital wallet app in Argentina? Turns out his background is a perfect foundation for starting a fintech company. In a podcast interview he said:

Financial inclusion can create middle class, better Republic, better institutions, and all of that will strengthen democracy. My working assumption of de-development of Argentina in the last 100 years is the lack of institutions. What’s the best we can do - bank the unbanked, they can build nest egg and get more interested in institutions.

This thinking is so un-orthodox - most of the fintech stories are started by people who either struggled with the current solution, or saw the opportunity to connect the dots. I am hardly pressed to think about anyone who started a company to strengthen democracy? Ualá is just one of the projects in Pierpaolo’s grander vision, it’s where he thinks he has the highest leverage right now, and once achieved, he will move on to new things. But he is having fun though - you can feel it if you listen to some of his recent podcasts, especially this one with Tyler Cowen (which in and off itself is a recognition).

With that grand vision up there in the sky, on the ground Ualá is crushing things too.

Strategy

Financial inclusion as defined by WorldBank:

Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way.

The first building block is a payment mechanism, or simply a card. As discussed above LatAm countries have some of the lowest levels of banking penetration in the world, which comes at odds vs metrics like smartphone adoption or GDP per capita.

Ualá started off from the premise of creating this payment mechanism first - a card that could be topped up and spent online and offline. More products and features will be added once people get used to the non-cash payment mechanism. Pierpaolo says:

Across Latin America, the reason we started Ualá is that over 50 percent of adults are in that situation of never having had a payment mechanism. You need to make it super easy, but it turns out you can teach people how to use a MasterCard because everybody wants Netflix, and everybody wants to have the ability to have Spotify.

So the digital payment mechanism allows for a few new things: spending online, not needing the branches and cash withdrawals, saving money on converting cash to digital transactions. Building out that payment history then allows for credit decisions. Spending analytics that Ualá provides helps people to save. Once they have savings they can start investing.

By offering a top-up card, Ualá was open to more people from day 1. Growth has been very fast - since the launch in 2017, the company has 3 million customers in Argentina - 10% of the country and a quarter of 18-25 years old. Recently the growth accelerated so much that the company is basically onboarding 1% of the country every three months. That growth is remarkable given competition from Mercado Libre (Ebay+Amazon+Paypal), an Argentine tech giant that has a PayPal like division called Mercado Pago with 20 million customers. However, Pierpaolo says the main competitor is cash.

Consumer product was enriched with additions of investments management, insurance, lending - basically a fully scoped banking proposition. However, that’s not the play. Ualá is building an ecosystem of networks, inspired by the success of Alibaba and WeChat in China (Tencent is an early investor). Pierpaolo says:

I think the value is in the whole ecosystem, and that’s something that we can learn in the new steady state that we learned from China, where people want to have all their money managed in very few platforms.

Ualá’s consumer product was soon complemented by business merchant acquiring solutions. If they are working on giving cards to customers, they also set out to build ways and paths where those cards could be used to buy things.

They have acquired a small bank with a banking license, but with ecosystem play there is more money to be made outside of lending - taking a cut on the movement of each $1 through the system is more profitable than parking that $1 in a loan, even at a super high interest.

The next long term bet is Mexico, and it is a country that is almost perfectly fitting Pierpaolo’s problem statement - banking the unbanked, providing financial inclusion. That’s why for 2 years out just 3 years in operations, Ualá was preparing to enter Mexico.

Execution

Today the core consumer product in Argentina is complete:

spending: debit card, bill payments - 3.5 million customers

savings: investments management - after 10 months of launch 730k accounts, now having over 1 million

lending and instalments

insurance

Business segment is also going strong with features including payment acceptance online and offline, expense management, set up with an online store-front ala Shopify.

Recently Pierpaolo broke down revenue sources, and there are four at the moment:

The biggest chunk is interchange, it is perhaps currently comprises a majority of revenue, but its share will be sliding as new features are built in

Investment charge fees, where they charge customers a commission on a % of AUM. Close to 1 million customers have onboarded - that’s 30% adoption of existing customer base. Ualá became the largest retail investment platform in Argentina and this is another great page out of CashApp’s book - the product and feature by itself is a customer acquisition channel.

Merchant acquiring fees where they charge about 4% on volumes vs 6% charged by the market. With network economies and scale, this side of the business can grow the fastest - Square makes half of revenue on merchant fees, and on a marginal basis - these fees are more profitable that anything else in the business.

Interest on credit - they have been cautious, and in Latin America with a rich history of crisis, recessions and devaluation, this is prudent. But also, going back to the strategy and ecosystem vision - Ualá might get to 20-30% of revenue coming from lending, but it doesn’t have an appetite to turn into a balance sheet lender.

Argentina is a large market, but it is also a more developed one, with better regulation (instant payments between banks), and a more affluent population. It was a sandbox to see if the product would pick up. Ualá joins Nubank in the battle for Mexico, but the space is hotting up.

Other challengers

When I wrote about Revolut, I mentioned that startup funding in one segment follows the Gartner Hype Cycle - the amount of funding going to Mexico will accelerate before slowing down, some companies won’t make it, but those who emerge will create enormous value.

Some of the exciting companies that are worth checking out include Albo, Stori and Klar. They are fundraising from Silicon Valley’s top VCs and breaking the app download ranks in the country. Alongside there are large challengers including the above mentioned Mercado Pago (Mario had a story on its parent company) and OXXO, a retail store chain that takes a ‘digitisation tax’. Packy had a good piece on FEMSA, the parent of OXXO, describing OXXO as follows:

In a country in which 60% of the people don’t have a bank account, OXXO is their “Pay Now” button. For those without a credit card, OXXO is where they go to pay for their Netflix or Spotify subscription, pay their electricity bill, or buy Fortnite V-Bucks. Stripe accepts cash payments made in OXXO stores, meaning that any company that uses Stripe for payments can sell its products via OXXO.

In March of this year OXXO officially stepped into fintech - by launching Spin by OXXO - a digital wallet through which customers can send and spend money.

We are going to see more multibillion fintech companies spinning out of the region pretty soon. Valuations, revenues, growth is all great, but the real upside here is the potential change in lives of hundreds of millions of people.