Stripe Should Be a Bank

Stripe is building the internet infrastructure. Paul Graham thinks it's the next Google. Should it become a bank?

Welcome to my new subscribers this week! This is my second post: long-ish read about Stripe. I hope you’ll enjoy it. Leave your comments after the post.

Stripe is one of my favourite companies - it is hardworking, curious and relentless.

In this deep-dive I look at Stripe, compare it against other companies and then go on a limb and say that Stripe should become a bank. I also explain why it won’t.

What is Stripe?

Payments done ✅

What Stripe did next

Stripe Capital

Bank as the Ultimate Fintech

Why it Won’t Happen

So What is Stripe?

Paul Graham, arguably one of the greatest investors, founder of Y-Combinator and early backer of Stripe said:

He is bullish on the premise, vision, and most importantly founders. But if you’re like me, you would associate YC with startups like AirBnB, DropBox, and Reddit - all consumer products.

Turns out Stripe, a business product, is the biggest company out of YC and the second most valuable private company in the US only behind SpaceX. It was valued at $36 billion last time it fundraised in April. Were it public, Stripe would have been worth 1.5x-2x more today.

What is Stripe?

Stripe’s founding story is as good as they come in Silicon Valley: two super smart college dropouts asked a simple question: “why it was so hard to make payments on the internet?” Brothers Patrick and John Collisons, who grew up in remote village in Ireland, dropped out of MIT and Harvard to start Stripe in 2010. As John explained at the time Stripe launched there wasn’t an easy way for internet companies to accept payments.

...you just want to be able to accept money from people all around the world. There have been, and certainly when we started Stripe, no good ways for you to do that and so that is the problem that we set out to address and it’s been really fun...

Stripe set out to solve the problem for developers. It is famous for its developer-first culture, great tech writing and documentation, easy integration with its APIs - e.g. famous seven lines of code needed to build a checkout page:

With Stripe, all a startup had to do was add seven lines of code to its site to handle payments: What once took weeks was now a cut-and-paste job. Silicon Valley coders spread word of this elegant new architecture.

The product was so good, that Stripe didn’t even need to spend on customer acquisition - people didn’t need to be persuaded to use Stripe, because Stripe was solving a real problem for them.

During 2010s two other startups were solving payments - Square was working for in-person payments, Adyen was competing for big enterprise customers.

Developer-first approach allowed Stripe to gain momentum spurred by tech transformation and growth of the internet economy. At the same time the growing importance of engineering voice in strategy decisions allowed Stripe to benefit from tech advocates for its solutions. Patrick said

Even the more traditional, stodgier companies that would have needed this super complex enterprise field team to engage with, they were actually now starting to listen to their own developers. And when the CTO said, “Hey, I really think we should be using this much more straightforward or much more powerful technology,” unlike a decade before, they were actually being listened to.

Many engineers and businesses that integrated with Stripe grew too. Stripe’s business model is adjacent to its customer growth which is a force multiplier. Stripe’s growth is a function of two separate growths: Stripe’s own compounding product market fit and Stripe’s customers business, i.e. without even growing a customer base Stripe’s business would increase just because their customers business is flourishing. This is a subtle but powerful momentum that makes achieving the scale much faster. And payments is a scale business.

Payments done ✅

Competitors Square and Adyen pursued different strategies. Square started supporting point of sale payment acceptance, but recently is focusing more on Cash App which is becoming a very prominent consumer finance app in the US (35 million active customers and approaching 50% of Square’s net revenues). Adyen from the start aimed at large enterprise customers in Europe (think L’Oréal and KLM).

In Q3 2020 Adyen processed over $90 billion for about 8 thousand customers - large enterprise customers with annual volumes of $35-$50 million. Square, a smaller company, processed just over $30 billion for an estimated 3 million customers based on 1.7x growth from 2015. However, growth in processing volumes vs Q3 2019 was just 12% for Square and 26% for Adyen. Compare that to Stripe’s enterprise stat:

Stripe’s volumes are in “hundreds of billions a year” and it has “millions of customers”. So conservatively I estimate that its annualised volumes are $200-$300 billion, similar to Adyen, given vertical swath of customers of all sizes. Covid also helped.

More volumes translate to more revenue, but payment businesses take only a tiny cut of transactions and Stripe has the better economics of both Square and Adyen.

In 2019 Square got to keep around 1% of the total volumes it processed (1.3% in Q3). Adyen’s margins are much thinner as it kept only ~20 basis points which is reflective of lower EEA interchange rates and likely discount pressure from big ticket customers.

Stripe’s net keep is probably higher than Square’s 1%, as Square is predominantly an off-line facilitator. So Stripe has the higher % cut, at the same time as having bigger volumes which translates to net revenues of $2-3 billion at least - higher than Adyen’s or Square’s.

This is impressive, but Stripe didn’t just stop at processing payments.

What Stripe Did Next

Stripe is shipping more high quality products that add a lot of value to merchants. It is also embedding itself deeper into merchant’s ecosystem. Keeping transaction revenue as the main source, Stripe invested capital incredibly well to develop further verticals:

Connect: allowing platforms like Uber and Deliveroo accept payments and pay to suppliers

Billing: allowing SaaS and other subscriptions based businesses like Tableau to bill customers regularly

Issuing: top up card for companies like Zipcar that drivers can use to buy fuel

Radar: fraud detection with significant savings results

Sigma: data and sales analytics allowing merchants understand their sales patterns and channels better

Today, an omni-channel retailer can onboard Stripe as a checkout mechanism. It can also get support for subscriptions billing, fraud detection, sales and revenue analytics, in-person sales support, issue cards for the business and also get a loan. All for an extra price where margins are higher than those of payments. There is little to no marginal cost of new products but the lifetime customer value is increasing many fold.

At the same time the company expanded to 42 countries (+Hungary just this week). But its speed of globalisation is probably only one of the very few things people complain about (another one is that Stripe doesn’t plan going public anytime soon preventing all of us from owning a share and upside it represents).

Stripe has created multiple frequent touch points with customers and have access to their wallets. But their customers bank elsewhere. Would it make sense for Stripe to close the loop?

Stripe Capital

Stripe launched Stripe Capital a year ago. It is providing working capital financing to customers based on their needs and trading patterns, without collateral, and with repayment taken as % of revenues. A great niche product to solve a specific need. Square, Shopify and a host of other players (including Amazon and Google) launched their lending arms.

Stripe didn't disclose the volumes, but going by Square’s example, they are not big.

Square Capital that was launched a few years earlier has lent out $5-6 billion to date (it is unclear how much was actually paid back). Revenue upside from this book is quite small given Square uses FDIC-approved partner bank as underwriter, and so probably just takes a cut, say 1%. So it would equate to a revenue of $60 million which is just 1-2% of its total annual revenue.

Square and Stripe are just facilitating these transactions. They can’t underwrite loans from their balance sheets, because a) they need to be a bank, b) they need a funding source. Square’s cash balance was just over $2 billion at the end of last year.

Bank as the Ultimate Fintech

A lot of successful fintech startup innovation is in “un-bundling” a bank - be it payments, money transfers (TransferWise and Square’s Cash App), investments and savings (Robinhood), lending (Zopa and Lending Club), etc.

But a lot of players who started from niche products are now transitioning to become banks - Klarna and Zopa are banks, and Square is in the process of becoming one. They do that to be able to offer new and pricier products, but more importantly, to own the whole value chain - from cheap funding in the form of customer deposits, to superior lending returns by keeping all yields.

Becoming a bank would boost Stripe’s offering against any payment companies, and more importantly against any banks.

There are three key reasons why it makes sense:

Stripe has a distribution network. By building payments infrastructure first, Stripe has created its own distribution network for any adjacent products like Radar, Sigma, etc. It doesn’t need to pay extra to acquire new customers (by far one of the biggest costs for banks)

Stripe knows its customers so can make better pricing decisions. It is already using the data for Stripe Capital. It can also base its credit decisions purely on the in-house data, which many banks don't have, to estimate the risks.

Stripe can plug the funding gap with deposits. Today Stripe processes payment volumes and returns them to customers' bank accounts. By keeping customer balances on its balance sheet, Stripe can leverage that funding to issue more loans, thus perpetuating the profitable cycle.

Why it Won’t Happen

Two reasons.

First reason - Stripe’s balance sheet is not big

Becoming a bank is costly.

There are large risks inherent in the lending model because of longer feedback loops from originating loans to realising returns (or losses). Covid made lending more difficult from a losses perspective too - Square reported pausing loans in Q2 as they needed to re-develop their eligibility criteria alluding to higher losses than expected.

Banking regulation also means that for every $1 lent banks need to set aside a capital, say 10% or 10p depending on the risk profile. So lending volumes comparable to Square of $5-6 billion would mean Stripe needs to keep ~$600 million of capital. Off course, $5-6 billion is origination over time half of which may have been repaid and its capital released. But the crux of it is that there is a linear relationship between how much a bank lends vs. how much capital it needs to set aside.

Today, it doesn’t look like Stripe has the necessary capital.

Stripe’s total assets are $2 billion. Most of the liabilities would be funds in transit owed to customers. Assuming it would be equal to 2 days of volumes in transit, the funds owed to customers would be $1.5 billion. This leaves the total equity of just $0.5 billion. Remember it needs a capital of similar amount to grow a loan book of $6 billion. With $1.6 billion raised to date it looks at over $1 billion of accumulated losses. Stripe probably only recently became profitable (Square’s first profitable year was 2019). It now makes total sense that Stripe went to raise $600 million in April.

Second and more important reason - I don’t think becoming a bank is adjacent to the founders’ ambitions.

So What is Stripe?

Stripe was founded by two brothers who had no idea how payments worked. So now they’ve grown the business to reach 40+ countries and process hundreds of billions of payments. But as students of history and progress they are interested in a bigger picture. John said:

The thing that gets me excited, and one of the things that we spent a lot of time thinking about at Stripe and trying to drive is what the second order effects are of that shift [internet economy]...

Stripe’s mission today is to increase the GDP of internet. It could be achieved in many ways. Stripe’s portfolio of activities is a very strong indicator that Stripe wants to be much more than just a payments company. There are many hats it wears:

Stripe as payment company

Stripe as entrepreneur champion

Stripe as investor

Stripe as social citizen

Stripe is of course at its core is developing payments and infrastructure. Things like identity verification, financial crime and fraud, tax collections, wider international coverage could all fall under the payments. These products would make conducting online business much easier.

But let’s look at other things Stripe does.

Stripe as entrepreneur champion

As entrepreneur champion, Stripe created one of the most impactful products for new startups. With Stripe Atlas for just $500 one off payment anyone from anywhere can set up their company in the US within days with all the required legal and tax paperwork.

Stripe bought IndieHackers.com - a community of and for entrepreneurs and side hustlers that stays independent. Stripe is very active in developer communities, Hacker News, etc. It understands that if it can inspire and help more entrepreneurs, the GDP of internet will grow.

Stripe as investor

Stripe is also a very prominent early stage investor and it uses its capital to write checks large and small. It uses venture arm to grow and support Stripe ecosystem, and to have a preview of potential acquisition targets.

Just recently it has acquired Paystack (Stripe for Africa) for $200 million. Stripe participated in its earlier funding rounds.

Its investment range spans payments, infrastructure, and banking. Among other prominent investments are PayMongo (Stripe for Philippines), Monzo Bank (I worked there), Step (banking for teenagers), Fast (one-click checkout service that is eyeing a $1 billion valuation).

Soon enough Stripe could actually have a very successful venture arm a-la Tencent (WeChat + international VC). By supporting new ventures and funding entrepreneurs, Stripe is directly increasing the GDP of internet.

Stripe as a social citizen

Stripe has always been incredibly vocal in social issues (climate change, fighting racism). Just recently they launched carbon removal scheme where merchants can contribute a % of their revenue via Stripe to invest in scaling carbon removal technologies.

Stripe Press, is a publishing arm behind the most beautifully bound books about progress, technology, history and entrepreneurship to inspire more people to become thoughtful change makers.

My favourite books include The Making of Prince of Persia, Working in Public and The Dream Machine.

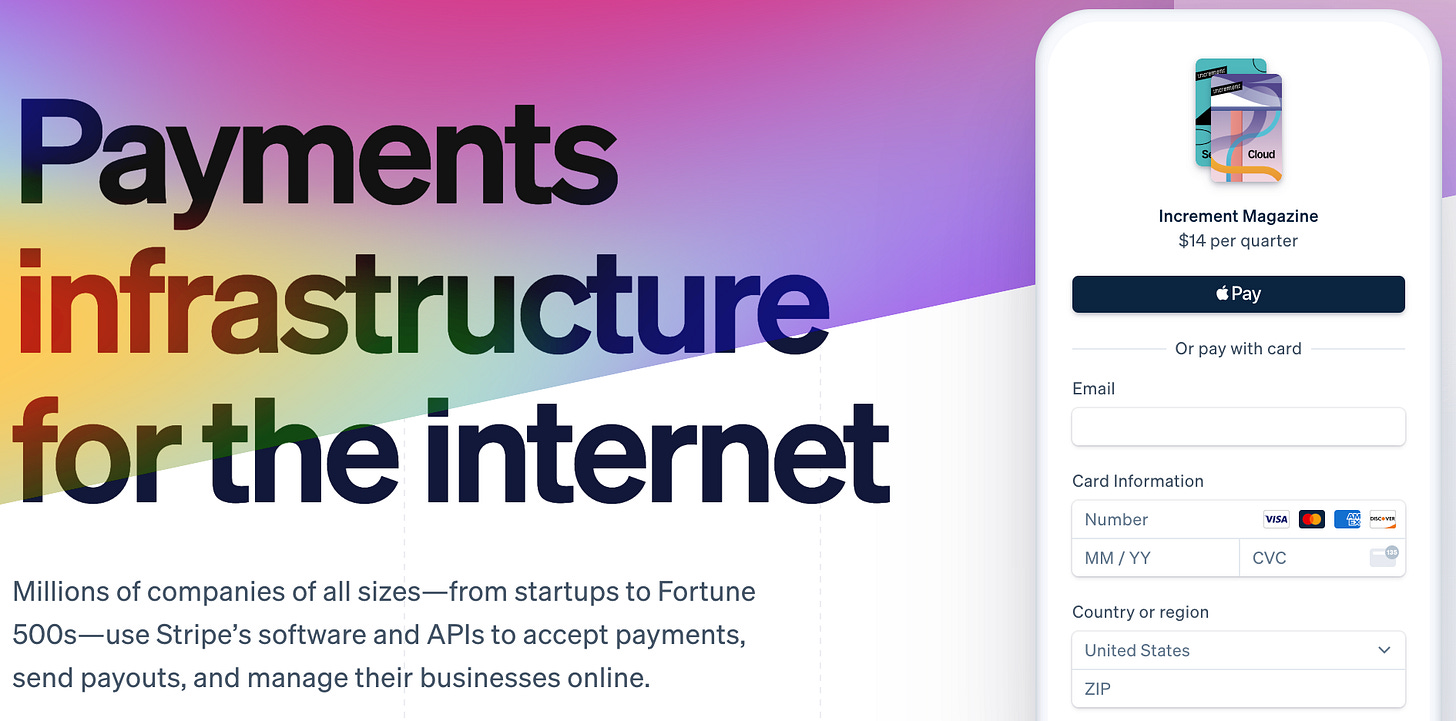

Increment is a quarterly magazine that Stripe publishes about how best engineering teams can build and scale. Each issue is dedicated to a specific topic like APIs, Testing, Programming Languages, etc.

By educating and inspiring people, Stripe is creating direct momentum in internet’s GDP growth.

As much as a former banker in me fancies the idea of Stripe finally having a scale to truly disrupt the traditional banking, I think there are very few companies pursuing an economic structure change and broad opportunity creation - so I will root for their primary mission.

From Patrick:

I think people in positions of influence or where they can have great impact, they should be obsessed with it [divergence of economic prosperity across the world]. It is an issue of true moral importance... Obviously, Stripe is one iron in that fire...

I like what you're saying but I don't think becoming a bank is the solution or the path they should take. If you want to use your Google analogy, then that's like saying Google should be the largest advertising agency in the world that every company should deal with. Take a look at your own article on Kaspi, Super Apps are rising to becoming tech category on their own, that's likely where the next Google is going to come from.