TransferWise and its Many Pivots

TransferWise proved that fintechs can be profitable. Along the way it didn’t shy away from pivoting. I think its transitioning from B2C to B2B and it might be the most important pivot yet.

It is said that a successful fintech is 10% good product and 90% cost-effective distribution. TransferWise has a great product. But its growth is dependent on how fast it can acquire new customers which will get more expensive. To solve for distribution challenges it is transforming from B2C to B2B.

In this profile I cover:

Business model

Money transfers: from P2P to traditional treasury management

Introducing borderless account and card

API for partnerships

Strategy: becoming a B2B SaaS

What’s the bear case?

TransferWise is a global technology company that’s building the best way to move money around the world. Today it is supporting 80 countries and counting, moving over £5 billion a month. It is one of only few profitable fintechs. There are even fewer companies that can claim to have a love letter from Ben Horowitz.

TransferWise was launched in 2011 by two friends. Taavet lived in London but earned his salary in euro. Kristo earned in pounds, but had euro mortgage in Estonia. Tired of paying exuberant and hidden fees to their banks, they had an idea - Taavet would pay Kristo’s mortgage, and Kristo would pay Taavet back in pounds. They realised there are many expats living abroad that would want the same deal.

This is a typical example of a successful tech disruption - find something that doesn't work or works poorly and make it 10x better. Even if the problem seems small, boring or difficult. Incumbents wouldn’t be able to catch up. It is telling that HSBC is launching a product a-la TransferWise merely 10 years after TransferWise.

Today TransferWise is valued at $5.5 billion with a 2200 people in 14 offices. It is one of just a few profitable fintechs - last year on the revenues of £303 million it made a profit of £23 million. It also grew its revenue 70% vs last year.

Their mission from the outset has always been to make the cost of transfer as cheap as possible, and eventually zero.

We want to make money move instantly, transparently, conveniently, and - eventually - for free.

For this bold mission to work TransferWise needs scale. One way to approach that scale is to become a B2B company. Let’s dive in.

Business model

According to McKinsey, annual revenue from cross border transactions by retail consumers was over $60 billion last year. A large portion of that is remittances or money sent “back home”. For example, there are many countries where remittances comprise up to 30% of countries' GDPs. As an extension, as much as 80% of cross-border volume was in cash pre-Covid. Move to digitisation is inevitable, but it has been very slow.

TransferWise is a digital money mover, targeting more affluent professionals and students who travel and live in different currencies. Competing with banks, rather than other money transfer companies like Western Union, TransferWise is optimising for speed and price against banks.

Today a third of its transactions are instant and 49% take less than 1 hour.

On average it charges ~0.74% on the volumes, but that varies across the currency corridors with some of the corridors being more expensive.

Unlike vertically embedded fintechs that can increase average revenue per user by offering more products, FX transfers is a scale business. At the end of the day, how much does one person need to trade FX per day, week or year? In 2019, on average each customer moved £6k cross-border, making a revenue of £43 for TransferWise. Unlike lending products where banks can fight for share of customer’a wallet, cross border transfers are more exclusive. Once customers trust TransferWise, they keep using the product. TransferWise doesn’t share data on retention, but their language speaks for it:

More than 7 million people and businesses have stopped using banks and traditional exchange services because TransferWise is cheaper, faster and easier to use.

So the only meaningful way to grow revenues from cross border transactions is via converting more customers, which is costly. TransferWise might have relied on customer “evangelism” in core markets, but getting more people in new markets to know the product and trust it with their money would be expensive.

So what’s the plan?

Today, TransferWise has three key segments:

Money transfers

Borderless bank accounts

API integration and partnerships

As one of the most successful fintechs, TransferWise has proven it can pivot. Probably their flat org structure where teams work independently on their self-defined goals has something to do with it.

Money transfers: from P2P to traditional treasury

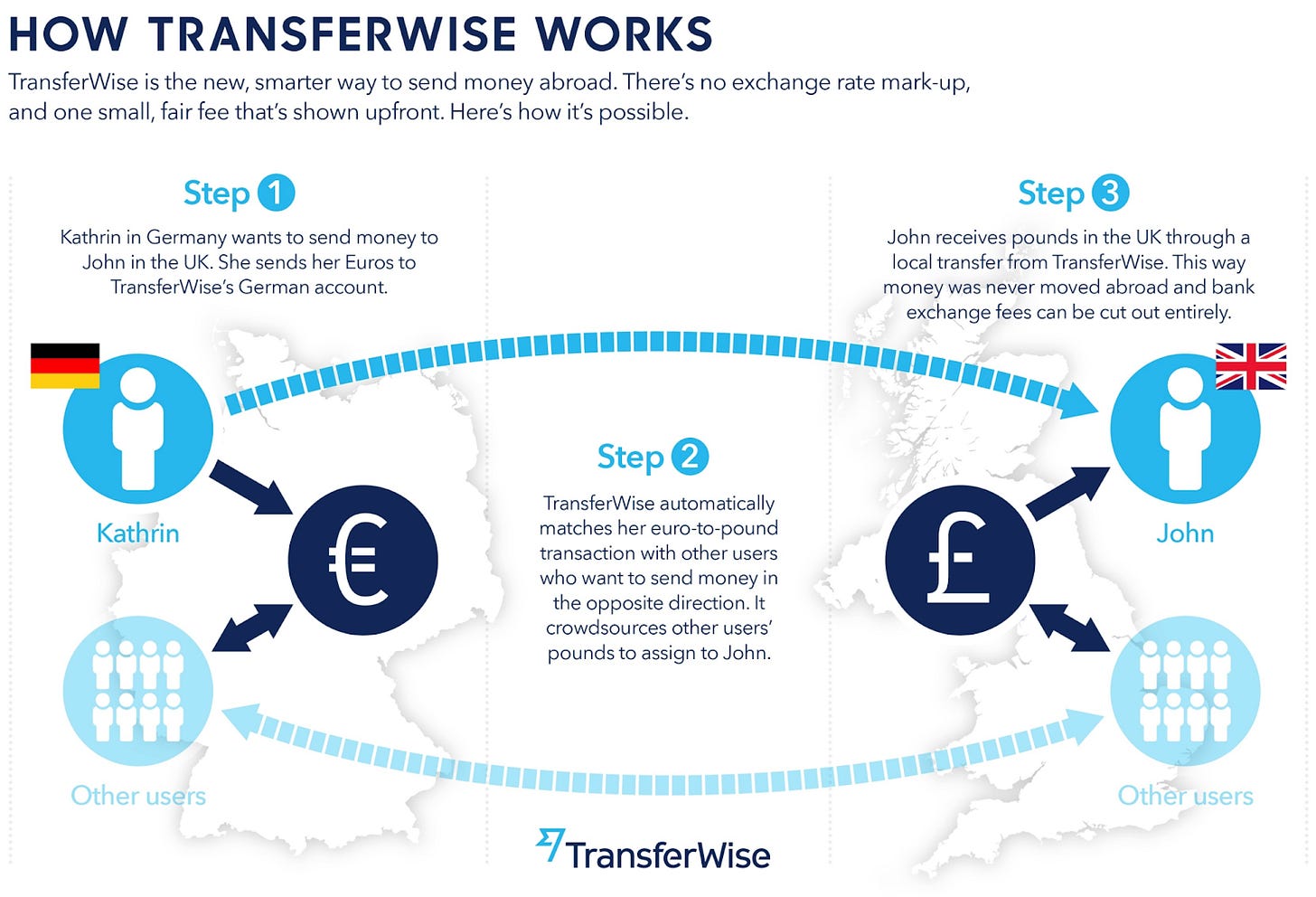

TransferWise thought that they’d make transfers cheaper and faster by finding reciprocal currency needs and pairing them up. Rather than actually buying, selling and moving currency, TransferWise would match demand on both sides, similar to how Taavet and Kristo matched their needs without money actually crossing any borders.

This ingenuity allowed TransferWise to significantly reduce prices - up to 8x, as a lot of costs associated with actual transfer would go away.

But peer to peer transfers worked only for high volume and high frequency corridors such as British Pound and Euro, or British Pound and Australian Dollar. As of 2016 they said:

[TransferWise] finds true peer-to-peer matches on at least 60 percent of its transaction volume on 20 “routes” among Europe, the U.S., the U.K., and Australia. Because of TransferWise’s prominence in Britain, almost every transfer into pounds is matched 100 percent peer-to-peer, says Harsh Sinha, its vice president of engineering.

However this approach would have been more difficult in other currency pairs that are more one-sided, and in other countries where TransferWise is not as well known.

“Our peer-to-peer model was an innovative solution at the time, but as we scaled, the original model wasn’t scaling with us,” said Käärmann.

So after a couple of years, TransferWise moved to essentially manage their treasury the same way big banks do it:

Where we don’t have reciprocal flows, then we will operate with partners in the affected country to acquire local currency, without passing the cost of doing that on to the customer.

This is more expensive. On popular routes such as GPB-EUR, they charge 0.3-0.4%, whereas on other less popular and more one-sided routes the prices can be higher. Last quarter TransferWise reported that the average price across business was 0.75%, recognising the fact that the volume in some of the pricier corridors was higher:

The real story was that some expensive routes had much more volume than usual and more cost-effective routes had lower volumes. To illustrate this, transfers from Brazil to Portugal cost 2.63%, while transfers from the UK to the US only 0.37% in fees. As it happened, we had a substantially higher share of volume from Brazil and other more expensive routes.

Nevertheless, majority of pricing quotes across currency routes are priced within 1% of variable fee (I scraped the data from TransferWise calculator to see distribution of pricing assuming bank transfer methods). These are also areas with highest volume, e.g. for the last three years Europe’s share of revenue is consistently around 50%.

Introducing borderless account and card

A few years ago TransferWise made another pivot - it launched global borderless bank accounts and debit cards that are now available in five countries and support storing 50 different currencies. With this TransferWise has embarked on “bundling” its core foreign exchange product with adjacent spend. Adding functionality like P2P payments, direct debits, savings and potentially investments, TransferWise account looks and feels like any other neo-bank account but with added benefit of storing and receiving multiple currencies.

TransferWise actually did better than many neo-banks. Since launching the product almost three years ago, TransferWise has 1 million customers who hold £2 billion of deposits. This averages out at £2k per customer, which is no mean feat. For comparison, Revolut’s average balance per customer was just around £250 last year. Considering that Revolut is a bank account provider designed to capture deposits and spending, TransferWise’s achievement is even more impressive.

Obviously, TransferWise found a product market fit for their borderless account product. As a proxy, the volume of non-currency exchange transactions, in other words, money people spent, grew from £9 billion in 2019 to £25 billion in 2020. Non currency revenue was ~£17 million. It would include things like interchange fees, card issuing fees and interest TransferWise might have earned on customer balances. The speed of change is incredible as the year before non-currency revenue was just £2.5 million, or 7x smaller.

This pivot showed that TransferWise in fact can increase its integration with customers, and by extension, its revenues per customer. However, not by much yet - share of non-currency revenue was just 5.6% of total. Even though that share could be increased further by converting more customers and expanding accounts functionality, this product is viewed as a means of achieving the mission of making money move easier. I don’t see TransferWise becoming a bank. Back in 2015 Taavet said:

The world of money transfer is huge - if you add up classic remittance, first world to first world money transfer, SMB segment, etc this ends up being huge. We think it’s important to be really good at something so we'll focus on expanding on what we have today - there are so many more source and destination currencies to cover for us. And once we're done with all of that we'll think of other stuff like micro-remittances.

But their next pivot to providing APIs to me is the most interesting and exciting one. TransferWise needs more cost-effective distribution and this is where API business shines.

API for partnerships

API or Application Programming Interface allows companies to connect on the back-end. This is the backbone of all SaaS. I wrote about Stripe last week which is an embodiment of the power of APIs. I also wrote about Kaspi, a successful fintech that I think needs to be opening up itself to external APIs. In other words, APIs are blood vessels for distribution of supply.

TransferWise from the start was operating as a platform matchmaker for P2P transactions. It would have both supply and demand and would be serving as a router between two people with different currencies. As I wrote above, it didn’t cover all of the regions and flows, because world is not symmetrical. This meant that TransferWise had to become a supplier - buying and managing its own currency trades in order to be able to serve the demand.

It was able to grow demand by incredible marketing strategies, crafting and generating user affinity and word of mouth virality (just google TransferWise marketing). However, in the new markets and under increasing competition, bringing new customers directly is going to get very expensive very soon.

One way forward to that is acquire customers at bulk.

Smartly, TransferWise from the beginning was open to partnerships with banks and other fintechs that wanted to have a currency transfer service on the platforms. TransferWise realised that these partnerships could chart a way for new distribution channels, and launched a dedicated bank partnerships team in 2018. Today TransferWise has 12 bank partners including Monzo, N26, bunq. Crucially it partnered with AliPay from China last year, and just this month with Up - a new Australian bank.

TransferWise is on its way to become a B2B.

Strategy: Becoming a B2B SaaS

TransferWise will always have a better product, because they are singularly focused on constantly improving it, and as such will always have an upper hand against competition who do international transfers among X number of many other things.

Any other company, for which FX is not a primary product, will have high opportunity costs of “inventing the wheel” again.

“A few big banks have come to the conclusion that their wire-transfer service was never a good experience for the customers,” Käärmann said.

TransferWise is positioned to capture the arbitrage by being singularly good at a specific thing it does. Patrick McKenzie of Stripe fame put it together nicely in relation to Stripe, but it is also true of TransferWise.

Distribution of the product will get increasingly expensive, putting positive accretion of margins from new customers under threat. For example, it now pays £75 for 3 customer referrals. To break even, each of this new customers needs to transfer at least £3-4k.

That’s why their strategic priorities are around building out scale distribution channels. A job description for bank integration team elegantly summarises the role of partnerships:

The TransferWise for Banks product is a key strategic priority for the next stage of the company’s rapidly growing platform proposition.

There are huge benefits of partnerships as distribution. For example, let’s assume that on average each of the 12 partner banks has 2 million customers and out of them 20% use money transfers. That’s almost 5 million customers which is more than half of what TransferWise grew to after 10 years (9 million). Each new bank partner will be adding a non-trivial amount of new customers, that would cost a fortune to acquire especially in new markets.

Importantly, more scale makes for a better product: liquidity and frequency in corridors drives prices down, TransferWise able to negotiate better rates where it needs to buy liquidity, develop better pricing and machine learning algorithms, etc.

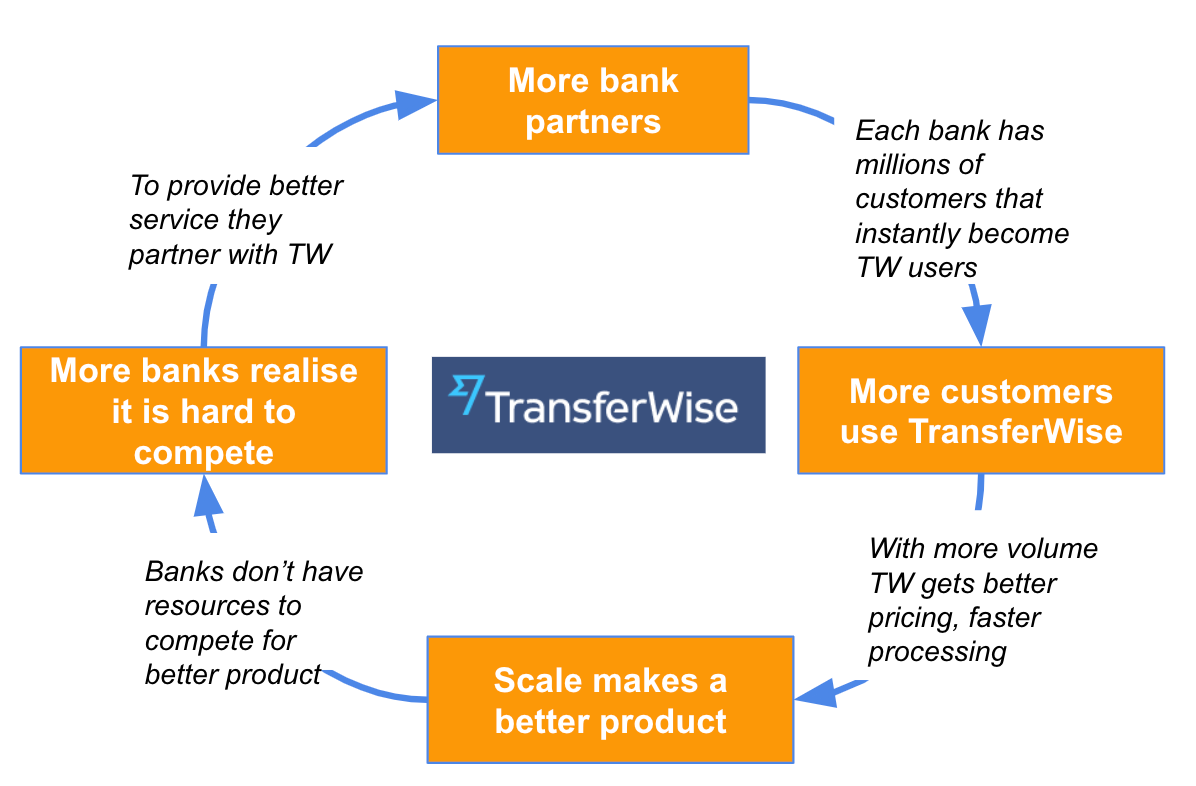

One of my favourite strategy concepts is a Flywheel concept: good business strategy can set off a giant profit accreting wheel in motion. One part executed well, pushes the next link in the flywheel. Partnering with banks, TransferWise can make a better product, with which other banks won’t be able to compete, which in turn brings more banks on its platform.

This way TransferWise can build its competitive moat: make the product 10x better and keep improving, so that eventually there are only two options that banks have: offer service for free, or partner with TransferWise (there is a third option - become TransferWise, but that only makes sense if it is key to the new strategy which would rarely be the case).

Similar to Stripe, TransferWise can solve a specific problem and be the best at it. Once ramped up, new and smaller banks would be jumping at API. The time will come when the bigger ones will get involved too, maybe even HSBCs of the world.

What’s the bear case?

Becoming a Stripe-like infrastructure backbone but in FX is a compelling vision in service of customers. But it is asking banks to either let go of their current FX revenue, or share any upside with TransferWise. Would they want that?

New banks are increasingly structuring themselves as platform aggregators. They build up and retain demand from customers, and on the other end they provide the supply which is either home made or externally generated.

These banks increasingly opt in to offer their own FX services, once they reach a scale. Both Revolut and Starling are now competing with TransferWise by offering similar service for their customers (albeit limited in scope). Last year Revolut’s revenues were £160 million (almost half of TransferWise’s, with more customers), and even £10 million from FX could materially increase the top line. Why leave money on the table?

Going back to the concept of opportunity costs, at some point not developing FX internally will get very expensive for some banks. As they grow and exhaust the list of revenue driving (and capital optimising) products, they would eventually get to FX. As none of these neo-banks are profitable yet they will be looking into in-housing more of services that have higher margins.

But it might not be the case for everyone. There are other banks and companies for whom FX will always be a tiny portion (e.g. for HSBC remittance is just 0.13% of net revenue). Usually banks that have profitable lending business for example would have a bigger fish to fry.

As TransferWise looks into near term IPO, it needs to solve its distribution problem, that is increasingly looking like an asymptote. Banking APIs are a way forward, TransferWise just needs to have a balanced pipeline of partners. The biggest thing that makes me bullish on TransferWise is that its management and founders have proven that they can pivot.

In Estonia, where our startup is based we use TransferWise on a daily basis. We admire this product. And it was such a pleasure to read this professional analysis from a person from my homeland! Keep rocking Aika! Regards, Askar