Holiday issue: Stored value cards and TfL Oysters

We leave ££ millions on unused store cards, gift cards, bank accounts and Oyster cards

This post caps my newsletter for this year. I started my newsletter just over a month ago, somewhat hesitantly. Initially I thought I would do a once-a-month deep dive, but I found my rhythm sooner than I expected. I was just having too much fun. Genuinely thank you thank you thank you for reading and spreading the word! I have been overwhelmed by the feedback and reactions. There are now 150 of you who get an email from me.

Please leave comments or reply to the email with your thoughts on what you want more of. I have lots of ideas for future newsletters, but I would be happy to hear back from you.

During my 6 weeks writing experience I wrote:

This year has been tough for everyone. And as we comprehend consequences and our life choices, I wish that next year we get to spend more time with those who matter.

Till next year!

Aika

Business of gift cards

Have you bought your holiday season presents yet (New Year Eve is the biggest holiday from where I come from)? There is a high chance you’re thinking about gift cards. According to the Deloitte holiday survey, half of us are thinking about buying a gift card. No wonder, the gift card industry is big and growing (from paper to digital). In the UK, by one estimate, the market is £7 billion strong, and there is a dedicated trade body Gift Card and Voucher Association (I was surprised, but I shouldn’t be as I found there are trade associations of upholsterers and carpet merchants too). The US gift cards industry is even bigger standing at $127 billion. Recently, gift cards are increasingly used by businesses for customer acquisition and retention (remember Amazon gift cards for referrals).

However, as people tend to forget or lose their cards, there is a significant proportion of value that goes unredeemed. Research from the US showed that 6% of cards are never redeemed. That translates to millions unspent credits which land as net profit to merchants. In the UK, 1.5% of shoppers didn’t spend their cards within a year (that number jumped up during Covid).

The origin story of gift cards goes back to Blockbuster in the 90s. They were the first to display and sell gift cards as merchandise. In 2001 Starbucks picked up the baton and is arguably the champion of stored value cards even today, having transitioned them to the app. This excellent blog shows that Starbucks is in fact a monetary superpower which has accumulated store credits to the tune of $1.6 billion dollars, or a whopping 10% of liabilities. This is all interest free funding that Starbucks can use for inventory, store refurbishment and etc. Today 17% of all Starbucks purchases are done via store app (they’re saving on interchange fees as well!).

As a result of Starbucks success, gift cards and vouchers proliferated widely. But I think we are actually about to witness a new trend in fast food loyalty schemes - subscriptions. They will be replacing the unpredictable nature of store credit cards.

Pret a Manger, a coffee chain launched a coffee subscription YourPretBarista in the UK amid first lockdown. There is unlimited coffee for £20 a month. Pret may not publish the results, but I haven’t seen the queues like that since the heyday of Pret pre-covid at lunch times in central London.

If we go by example, Panera Bread, a US fast food chain that launched a coffee subscription of $9.99 early this year, already had 835k subscribers in August. That’s over $100 million annual recurring revenue out of the bat. Not bad. Moreover, the second order effects of increased traffic frequency and higher basket size are actually bigger.

I think we’re going to see more of these chains going into subscriptions business.

Value for merchants

But going back to value cards, there are two direct financial benefits (more if you include second order effects):

Funding - by selling the product in advance merchants can use the funding for production and inventory of the new cycle. Whilst revenue can only be recognised when the product is consumed, companies can start using the free cash straight away

Revenue - even though the majority of gift card values are claimed within a year, the unconverted amounts or so called breakage is a direct revenue for companies. Some of the biggest names rake up millions in unused credits

There is a reason why retailers love gift cards so much. From John Lewis to Waterstones, from Apple to Nike, from Amazon to Spotify, everyone is embracing the product.

Details from the annual reports are scarce, but for example, Waterstones has £17 million in store credits - gift cards and bonus points, assuming the average book price of £20, it is equivalent to 850k books or about a half of monthly sales! Marks and Spencer has accumulated £180 million of such liabilities. I couldn’t come by breakdown from tech companies of the likes of Spotify and Apple, but walk down the grocery store isle and the sheer number of offers is mind blowing.

Non-purchase credits

Gift cards might be the most obvious example of customers leaving money on the table. But think about it - it is actually everywhere, from money on unused bank accounts to credit in travel cards like Oyster (I for one could probably count 5-7 cards Oyster cards).

Banks in the UK are now transferring unused customer balances to charities. I think its a great idea! If customers balances haven’t been touched for 15 years, banks in the UK can channel the balances to a non-profit body called Reclaim Fund which then distributes and endows various social enterprises and charities. In 10 years that the fund has been alive, it has accumulated £1.35 billion, with £100+ million being transferred every year. The largest beneficiary is a social impact investment fund Big Society Capital that has received £600 million and invests in education and housing.

Another social good - public transportation also has a large unclaimed balance, which it hasn’t yet decided how to use.

Oyster cards

Oyster cards were launched in 2003 as a way for Londoners and visitors to avoid using cash payments on journeys. You would first purchase the card for £5 at kiosks and top it up either for Pay as you Go balance, or pre-purchase credits for a week, month or a year. Very quickly Oyster cards became the main token by which people accessed London transport. It is only last year that Oyster’s usage was surpassed by contactless payments. But the Oyster stored values not only declined, they kept growing.

As of September 2020, deposits and topped up values reached £600 million on the balance sheet of Transport for London (TfL a public body). This is equivalent to almost £7 per card - enough for 3 journeys on the tube.

But the question is how much of it is actually “unclaimed” and as such could be spent by TfL on, say, signal issues?

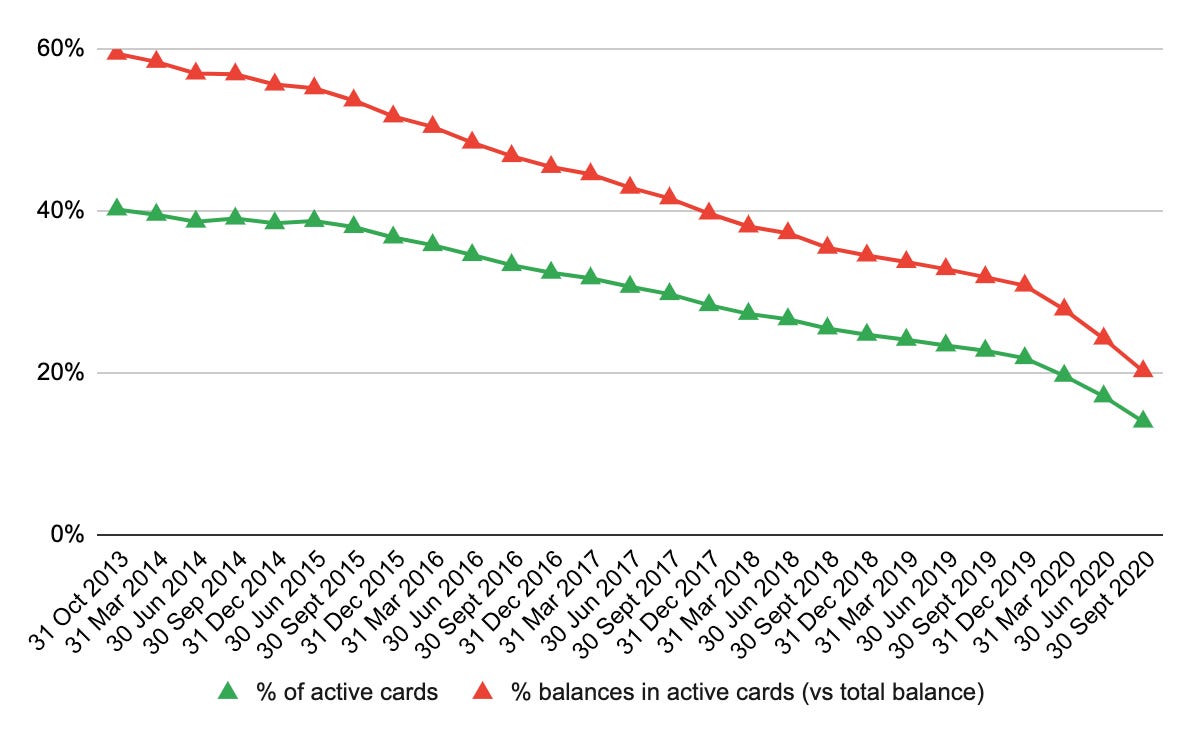

The share of active Oyster cards (or the ones that have been used once in the last 12 months) is ever declining, now standing at 12%. In other words, as of September, 88% of Oyster cards haven’t been used for a year (there is no significant Covid induced drop, suggesting that the trend started much earlier). That corresponds to over 80% of unused card balances.

In other words, out of £600 million of total customer balances that TfL holds, £480 million haven’t been accessed for a year. I think the chances that these balances will be redeemed are very low. Who knows, perhaps in a few years we could launch some new social impact vehicles with that money or finally fix the signalling.

This analysis, as well as the output from other merchants, shows how advance value cards can benefit the merchant. If anything I wonder why not more merchants are doing it. For you dear reader, it is also a reminder to dig up those credits and spend them too (or trade them here and return your Oyster cards to the kiosks).

Simple reason: gift card has a lot of regulatory burden (esp. in EU) and there are so much fraud associated with gift card. Sometimes the costs outweigh the benefits and the operational costs is also extremely high.